Proper Insurance vs. Landlord Insurance – Which is Best For Short-Term Rentals?

Commercial/Business Insurance vs. DP Landlord Insurance: Which is right for home sharing? The #1 question we receive from our home-sharing clients is a question about Liability Insurance.

It’s unfortunate, but in the world of insurance, especially with home sharing, you never truly know what you have until it’s time to file a claim. Our sales staff spends countless hours educating our clients on what commercial general liability is and why they need it for a vacation rental property.

The Problem With Short-Term Rental Policies

We hear everything from our home-sharing clients. The most discomforting thing we hear is that they are currently insured with a short-term rental policy from another carrier. Why is this so discomforting? Because 95% of the time, it’s a DP-3 Landlord policy that has been branded/marketed as a short-term rental policy.

You can’t simply add a line item to a policy and call it a home-sharing, short-term vacation rental insurance policy. Or can you? Apparently, you can because a 1/2 dozen carriers are doing it. And all of them carry Premise Liability, not Commercial General Liability, as found in the Proper policy.

Understanding Liability in Home-Sharing Insurance

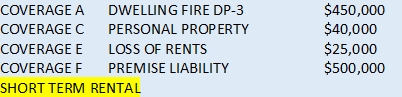

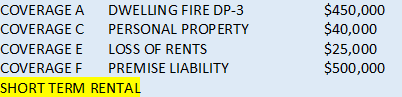

If your policy or the quote you have looks anything like the above snapshot, then there are some important things you need to know. The key terms you are looking for are Dwelling Fire-DP3, Personal Property, Loss of Rents, and most importantly, Premise Liability.

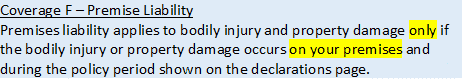

Let’s dig into the liability first, as this is the single most important exposure to understand when owning and insuring a vacation rental property. Above is the actual language for Premise Liability. It clearly states there is coverage for bodily injury and property damage ONLY if it occurs on your premise.

That sounds great. But what about bodily injury or property damage that could occur away from the premise? And how could this be tied back to my vacation rental or home-sharing scenario? Great questions.

The reality is there are many incidents that could occur away from the premises/vacation rental that you need liability coverage for. Let’s list a few real examples:

-A renter brings their dog to the vacation rental during their stay. Even though you do not allow dogs. The renter walks the dog, and the dog bites a child off-premise. The child’s parents sue not only the renter but you, the owner as well. People sue both parties. This occurred away from the premise. Note: The average dog bite claim in 2015 was $37,200, and the total claims paid was $570 million.

-You offer bicycles as an amenity to your vacation rental. A home-sharing guest rides a bicycle into town, and the chain falls off, resulting in a crash and bodily injury to the guest. The guest goes to the hospital, and their health insurance company sues you, the vacation rental/home-sharing owner, for bodily injury. This occurred away from the premise.

-You rent your vacation rental to a family for the week of the 4th of July. The family purchases fireworks and sets them off at sundown. One of the fireworks lands on a neighboring home, and as a result, the home burns down. The neighbors’ homeowner’s insurance company sues you, the vacation rental owner, for the property damage of the house. This is property damage that occurred away from the premise.

There are hundreds of home-sharing examples. All of these are real-life examples that WOULD NOT be covered under Premise Liability as the bodily injury or property damage occurred away from the premise.

Premise Liability VS. Commercial General Liability

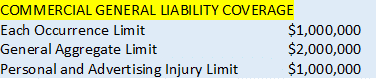

You purchase a business insurance policy that carries Commercial General Liability, as seen in the above snapshot. Coverage under Commercial General Liability not only covers bodily injury and property damage at the premise but extends beyond anywhere in the U.S. The Proper Insurance policy would respond to all three examples mentioned in the previous section.

Commercial General Liability Defined: A standard insurance policy issued to business organizations to protect them against liability claims for bodily injury and property damage arising out of premises, operations, products, and completed operations; and advertising and personal injury liability.

You may be asking what is Personal and Advertising Injury. And is this even needed for a vacation rental/home-sharing property? Yes, it’s needed for two reasons. 1) invasion of privacy, and 2) slander. Believe it or not, we do see claims arising from invasion of privacy. Typically, this happens when a cleaning crew comes to the vacation rental early by mistake and invades the privacy of the guest.

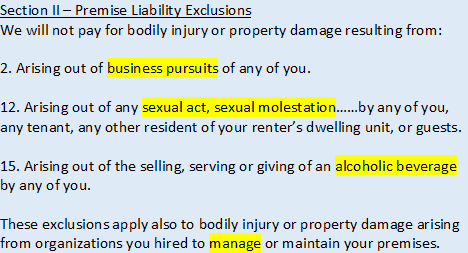

The below snapshot shows a few other exclusions that are very concerning with Premise Liability. The biggest, in our opinion, is the business pursuits. I guess the $1,000,000 question would be: is your vacation rental a business? If it is, then there is ZERO liability coverage at the premise. Nothing.

What does this mean exactly? What it means is at the time of a bodily injury claim, if the insurance company deems “short-term renting/home-sharing” a business pursuit, then there is no coverage. We always stress to our clients that everyone is subject to the language in their policy, and the bottom line is a DP-3 Landlord policy carries a business pursuits exclusion. If you want business coverage, you purchase a business policy, not a landlord policy that is designed for landlords.

KEY POINTS: Assuming the bodily injury did not occur off the premise, and the insurance company doesn’t deem “short-term renting” a business pursuit, there are some additional exclusions that must be noted. See the same snapshot below.

Since the Proper Insurance policy is a business policy and we remove the liquor liability exclusion, all of the above are covered as well. Also outlined below.

-Business pursuits (covered)

-Sexual assault/molestation (covered)

-Alcohol furnished by rental (covered)

-Property Managers (automatically additionally insured)

Property Coverage

Now that we have thoroughly covered Premise Liability VS Commercial General Liability let’s go back to the original snapshot of a DP-3 Landlord policy and look into property coverage.

Loss of Rents: This will pay you the fair market value of lost rental income in the event of a covered loss and is usually capped at 12 months. Fair market value is the average rental price found in your area. This is not good because short-term rentals have a much higher rental price than the fair market. The cap at 12 months is also a limitation because in the event of a total loss, depending on the location and quality of the property, it can be 18-24 months until the property is fully rebuilt and back to normal operation.

The Proper Insurance policy carries “actual loss sustained” business income coverage with NO time limit. This is far superior to the loss of rent. When you own a business (vacation rental/home sharing), you want business insurance.

A FEW OTHER IMPORTANT POINTS:

- A standard DP-3 Dwelling policy does not cover vacant properties. The Proper Insurance policy removes the vacancy clause, so if the vacation rental goes more than 60 days unoccupied, it’s covered.

- Many DP-3 Dwelling policies carry “Actual Cash Value (depreciation)” in the event of a partial loss, and also ACV for contents/personal property. The Proper policy is replacement cost, “new for old,” for both buildings and contents.

- Most DP-3 Landlord policies carry a special form (all-risk) coverage form for building, but carry a broad form (limited to named perils only) on contents/personal property. The Proper Insurance policy carries special form coverage on all buildings, contents, and business income.

- Most DP-3 Landlord policies do not offer coverage for sewer and drain backups, which are very common claims. The Proper Insurance policy provides coverage for backups of sewers and drains with no sub-limit.

There are dozens of other areas where a DP-3 Landlord policy is limited compared to a Commercial Policy.

Please call us at 888-631-6680 with any questions, as we truly believe in selling through education.