Game Plan: Setting Up Your Short-Term Rental for Super Bowl Success

Many of you are probably all booked out for television’s biggest weekend: Superbowl Weekend.

Major events like this can be an easy opportunity to fill your vacation rental, but you may want to proceed with caution as these aren’t your typical guests. Whether it’s a local youth group or old college buddies, many guests are Airbnb-ing a place to kick back, invite their friends, and watch from the comfort of your home on your new flat-screen.

Here are a few pro tips to consider before kickoff.

Play No.1: Know the Away Team

For televised events like the Super Bowl, you don’t often see groups booking from out of town, so a simple way to identify if your home is set for a disastrous weekend is to do a little research on your guests. Pay attention to where they are coming from. If they are from the same town where they are booking, it’s likely they’re booking a gathering, regardless of whether you indicated “no parties” in your listing.

Since the Super Bowl is so widely followed, you can pretty well bet that groups booking for this Sunday are going to be enjoying the game. You can ask that they remove their shoes, limit the number of guests, or not eat/drink in certain rooms, but ultimately, you just have to trust that they’ll respect your home.

Play No.2: Hope for the Best, Train for the Worst

As a host, you should anticipate potential damages. Just as a football coach preps his team for the big game but still plans for unforeseen occurrences, short-term rental hosts must also have a solid game plan.What if there is an injury or the weather rolls in? There are simply too many things that can go wrong, and so the best teams have extensive plans for when disaster strikes.

As a short-term rental host, you need to have such plans in place as well, and one of the key components is your insurance policy. So, given that the Super Bowl means parties and parties can lead to damages and theft, what kind of coverage do you need to ensure you’ll have protection? The answer brings us to another one of our top short-term rental claims — guest-caused damage.

Intentional or Expected Acts of Theft and Vandalism

Now, we can all agree that if the neighbor kid spray paints your siding or breaks in to steal your flatscreen, this would certainly fall under theft and vandalism. But what if your guests throw a party and something is damaged or goes missing? Is this the same thing?

Assuming the cost of replacement exceeds your deductible, you would call your insurance agent to file a claim, but it’s important to note that this claim is NOT the same as theft or vandalism by way of a break-in of your home. This claim falls under a completely different section, and you must know how your policy defines coverage.

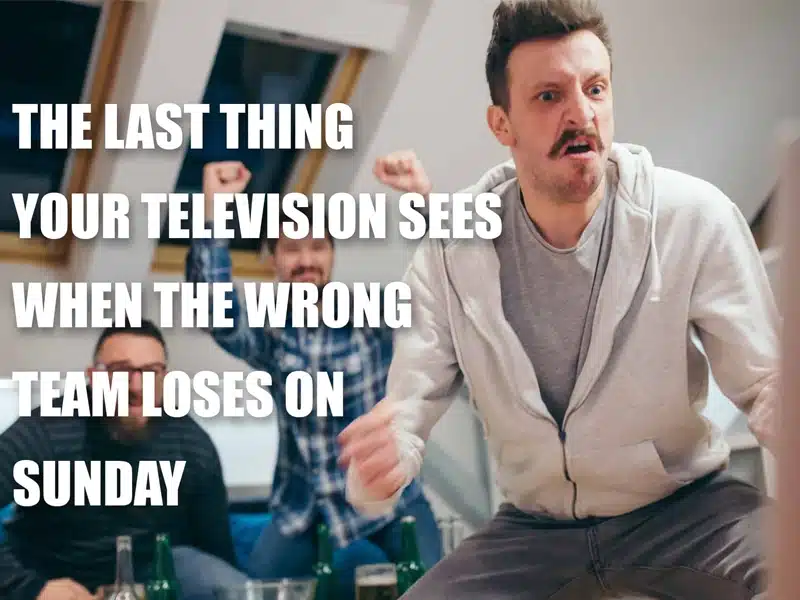

If the damage caused by your guests is less than your insurance deductible, having vacation rental damage protection in place, like Waivo, would help cover these costs. Waivo is a revolutionary approach to guest-caused damage that requires no guest involvement, offers broad protection with no deductible, and supports hosts with an intuitive client portal and speedy reimbursement process. Waivo could cover damages left behind from a Super Bowl party, like A TV smashed by a fan enraged over their team’s loss, a coffee table body-slammed in true ‘Stone Cold’ Steve Austin fashion, or a couch-stained from face paint whether from joyous cheers or disheartened tears.

Sneaky Exclusions: Property Entrustment

The difference between break-ins and guests who already have entry is defined by a key exclusion in nearly all homeowners’ policies. This exclusion is called “Property Entrusted to Others” and, in a nutshell, states that ‘theft’ or ‘vandalism’ coverage is excluded IF the property is entrusted to someone else (i.e., you give them the keys).

The easiest way to understand this is to think about why an insurance company would remove this coverage. Imagine letting a relative use your home while you’re away for the weekend. They have a few friends over, but it gets out of hand, and before they know it, there’s a full-blown house party at your home. With scratches on the hardwood, beer on the carpet, and art and electronics missing, you’re out $20,000 because of their poor choices. So you call your agent to report the claim; after all, you have coverage for theft and damages, right? Not so fast, you knowingly gave your relative the keys to your home, thus entrusting the property to them. What is your insurance carrier’s response? – “Take it up with your relative. They owe you $20,000.”

The same goes for short-term rentals, and the fact that you are entrusting the property to guests in pursuit of profit only makes it less likely that your insurance company will assist you. This isn’t a backup play. It’s a forfeit. What you want to see is this specific exclusion removed from your policy entirely. With a policy like we offer at Proper Insurance, this is the case, but this is only because we have custom-written our policy for short-term rental businesses. You’ll want to run this by your agent in advance so you know what to expect.

Separate Coverage Limits: Malicious Damage

The second item to look for is a separate limit for theft or vandalism by guests (i.e., the dreaded Malicious Mischief exclusion). While intentional acts of theft and vandalism rarely carry separate deductibles, we often see them carry a separate limit that details the max your insurance company will pay for theft or damage by guests. This is an important limitation to address with your agent, as these exclusions are seen most often in policies that claim to be written for short-term rentals.

Remember, insurance always comes back to risk, so insurance companies who understand that a short-term rental home is more likely to have items stolen or vandalized by guests are going to do one of three things:

- Exclude the coverage altogether

- Charge more premium for the added coverage

- Charge a little more, but greatly limit the coverage and therefore their risk

In this case, number three is the route many supplemental and less comprehensive short-term rental policies choose to take, and many of these policies limit coverage for theft and damage by guests to as little as $2,500.

At Proper Insurance, we take the second option. We have to charge more premium for the additional risk, BUT we offer full coverage up to the policy limit that you specify for the structure or contents. So if you have coverage for $50,000 worth of stuff, and a guest whom you’ve entrusted the property to pulls up in a U-haul and cleans you out, you would have replacement cost coverage up to your limit of $50,000. It’s just that simple.

Play No.3: Listen to the Crowd

These days, there are plenty of tech options to keep people from breaking into your home, but what about once they’re inside? Can you still monitor your home once your guests have checked in?

Well, it turns out the team at NoiseAware has come up with a simple solution that plugs right into your wall. The outlet-sized device measures the volume level in your home and uses WiFi to alert you when it sounds like your guests may be having a bit too much fun.

This can help prevent noise complaints from your neighbors, parties from getting out of hand, and ultimately, theft and damage claims. The device doesn’t eavesdrop on the specifics of your guests’ conversations but simply monitors the overall noise in the home. Think of it as listening to the screaming fans in the crowd from the field. You can’t make out what they’re saying, but you can tell when they’re excited!

At Proper, we’ve found that clients who have the NoiseAware system installed see far fewer claims as a result, and because of this, we’re able to offer a premium credit to clients who have this device.

Overtime Tip: Verify Your Short-Term Rental Insurance Today

It can be tough to know what your policy covers without going through each possible scenario. For this particular claim, a good place to start is with your current insurance agent. Send them the following question and see what they have to say. Just make sure your agent is getting the answer in writing from the underwriter of your policy.

Question: “If I entrust my property/home to a paying Airbnb/Vrbo short-term rental guest for three days, and that guest throws a party and vandalizes, damages, or steals my property, do I have property coverage to the limits of insurance?”

We’re happy to provide a coverage comparison as well, so if you have questions about your current policy, give us a call at 888-631-6680 or submit a quote request.